*The opinions expressed in this article are the author’s own and do not reflect the official views of ICMR.

Every time we scroll through an app, our social media ads, browse an online sale or get our coffee, we are not just spending money, but we are part of a silent competition for our wallet.

In Malaysia, it is clear that consumerism wins the wallet war. From cashback, limited time deals or even easy one-click checkouts from our favourite coffee and online shopping app. We are constantly filled with small design choices that guide us on when, how and why we spend or save. These choices are not random but are a deliberate behavioural design that can either help us make better financial decision or quietly steer us away from them.

The Subtle Power of Behavioural Design

In behavioural science, we call these design features “nudges”. A well-designed nudge can encourage us to make decisions easier and better. It depends on who are applying them, nudges have been used by many shopping apps such as Grab, Shopee, TikTok Shop and many others to encourage more spending by making it seamless and more alluring. If used well by policymakers, nudges can encourage us to make better choices aligned with our long-term benefits.

But not all designs work in our favour. I am sure many of us have experienced subscribing to a service like an app or premium e-commerce membership that requires to enter your card details and then forgotten all about it until they automatically charged you again after one year. No reminder. No warning. And when you try to unsubscribe, it takes five pages of fine print, misleading buttons, and long hold times. This is not poor design. This is “sludge” which is a subtle but deliberate use of friction to slow you down or confuse you, especially when you’re trying to stop spending.

The Wallet Battlefield – Spending vs. Saving by Design

It’s hard to deny that in Malaysia, consumerism outpaces the culture of saving and investing. To put things into context, Bank Negara Malaysia (BNM) reported that active BNPL users jumped to 5.1 million as of end-December, from 4.3 million at end-June.1 And while individuals bear some responsibility, the design of our financial systems and digital experiences often tip the scales in favour of spending over saving.

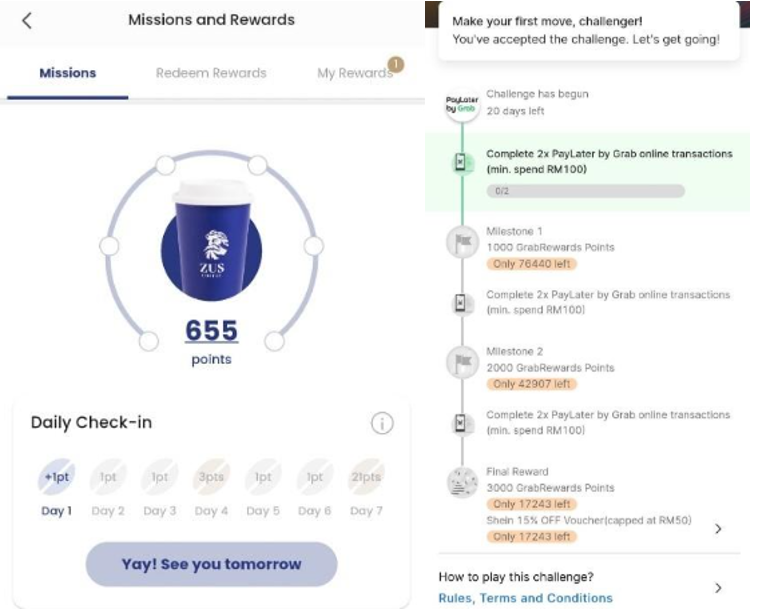

Coffee apps preload your preferences. Online shopping carts remember your details. Flash sales shout “Buy now!” at every scroll. In Malaysia, platforms such as Shopee, TikTok Shop, Grab or food ordering apps, Zues Coffee are designed to gently nudge you into spending while offering behavioural hooks like cashback rewards, limited time offers, or countdown timers. They gamify consumerism, and they do it brilliantly.

Examples below:

Timely nudge to spend

Gamifying Spending

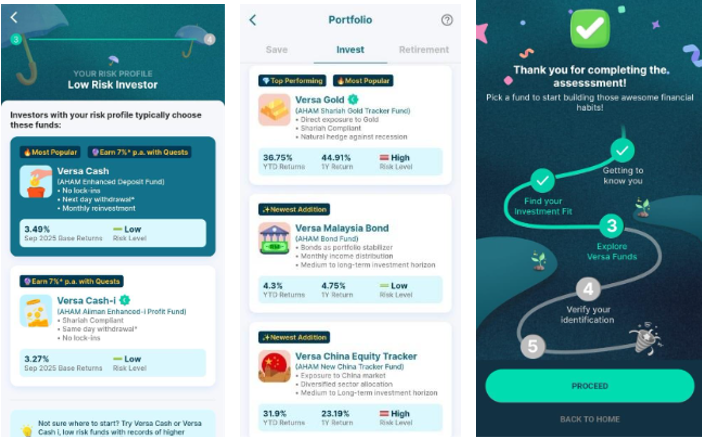

What’s concerning is the imbalance. While technology has made spending seamless and addictive, saving and investing still feel like chores. Want to start a retirement fund? Get ready to go through choice overload with various funds, coupled with multiple forms, upload documents, and verify your account, where most often are done manually. While shopping apps provide seamless access with instant “buy now, pay later” schemes in just one click away.

When it comes to the competition for your wallet, it seems like the spending machine is winning.

Rethinking Friction in Financial Wellbeing

ICMR’s past behavioural research, including the report “Motivations and Drivers Behind Savings Behaviour”, reveals that present bias, inertia, and a desire for convenience are deeply rooted in how Malaysians approach financial decisions. This means the design of our financial ecosystem is very critical. If it’s easier to spend than to save, you will tend to naturally end up spending.

What we need is a level playing field, one where the same behavioural science that powers consumer apps can be used to support long-term financial wellbeing. Imagine a savings app that nudges you to round up spare change after each transaction. Or a robo-advisory tool that adjusts retirement goals based on lifestyle patterns rather than abstract targets. These are not far-fetched ideas, but they are already being used in some other markets and can be tailored for Malaysian users.

As an example, a new investing app Versa has done a great job in applying this idea with their gamification strategy and easy to understand design, it really resonates with user especially the younger generation.

But one organisation may not be enough to win the battle. Financial agencies and industry players must build on such examples through deeper collaboration by linking savings and investment apps with the wider banking ecosystem. In doing so, Malaysians could enjoy a seamless, holistic financial experience, improve mental accounting and reinforce positive financial behaviours.

Designing for Good

If we don’t compete for Malaysians’ wallets with better design, someone else already is. Policymakers and agencies can make good behavioural design that make saving as effortless and rewarding as spending.

Policymaker and financial institutions can build on existing systems to create goal-based savings tools such as linking banking apps to EPF or ASNB accounts through secure APIs. With the right data standards, collaborations between banks, EPF, and PNB could offer Malaysians a seamless, automated way to allocate funds toward long-term goals.

As a reference point, models like the Singapore Financial Data Exchange (SGFinDex) which integrates financial data across banks and agencies under one consent-based platform, show what’s possible. A similar model in Malaysia could make financial management holistic, transparent, and user-centric.

Finally, good design must be evidence-driven. Whether through regulatory sandboxes, behavioural experiments, or RCTs, we should rigorously test what truly drives better financial outcomes, not just what drives clicks. Because at the end of the day, good design should not only capture attention, but it should also build confidence, trust, and lasting financial resilience.